You can appoint whom ever you wish as executor of a

YF Will

You can appoint lawyers or banks as executors of a

YF Will

YF Will covers all possible circumstances, and

is easy to administer

Choice of executor important to heirs benefits

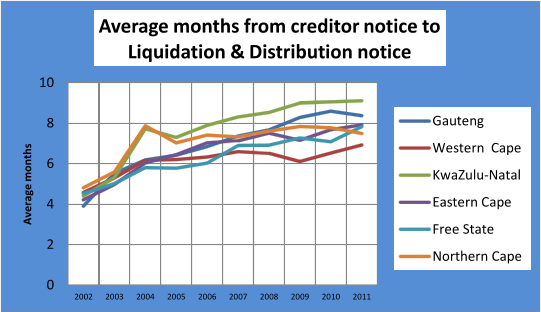

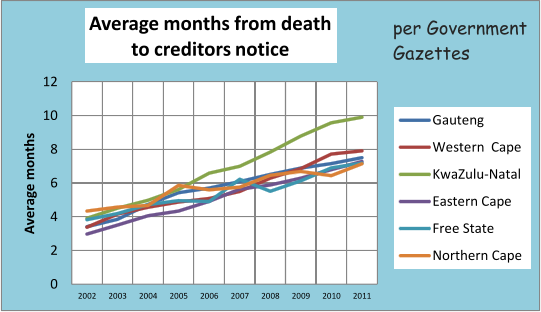

Delays in finalisation and paying heirs result in a hidden loss

of benefits to heirs. Hidden because heirs are bearing

the cost of interest that would not be paid interest if

their liabilities had been repaid. Heirs without debt loose

the opportunity to make income. A 12 month delay can be

a loss of heirs benefits of 12%.

Check historic performance before naming any or accepting

free or low cost wills in lieu of naming as executor.

In addition 6% of all income earned until the the date of

distribution is charged as executor fees.

Heirs as executors or co-executors.

Executors fees

Executors can be given powers to employ others to do

those aspects of the administration they don’t want to

do or think they cannot do.

Heirs’ only interest is in speedy resolution of estate.

Heirs can assist getting information required to register

the estate.

Heirs can visit the Masters office to encourage prompt

executor appointment.

Family members, especially the surviving spouse, know the

family assets best.

Family members are better able to safeguard the assets

of the estate until distribution.

There are no laws disqualifying a spouse or any other heir

from being executor. The Master may require a formal

appointment of assistance if the executor named in the

will cannot demonstrate they are capable of preparing

the Liquidation & Distribution accounts or is not

resident in South Africa.

More than 95% of estates are straight forward, it is the

will that is not conclusive leaving areas of indecision

that cause delays problems and conflicts.

Executor fees are computed as 3.5% plus VAT of the gross

value of the assets of the estate. Where the value of

property is R500 000 against which there is a bond of

R300 000 the fee is computed on R500 000 even

though the value of the estate is only R200 000.

Where the surviving spouse is the sole beneficiary be

certain to name the surviving spouse as the executor.

They know their assets best of all.

Sole beneficiaries who are executors would not charge an

executor fee other than to recover fees charged where

assistance was obtained. It would be silly to charge a

fee that would be subject to personal tax when all the

assets are theirs.

Executors

Average performance over last 10 years

The New Generation Will

Invest in your heirs giving them

all the benefits